Key Takeaways

- Apple Pay Later offered interest-free loans for purchases between $50 and $1,000.

- The service is being shut down and replaced by a global installment loan offering.

- Existing Apple Pay Later loans and purchases are not affected by the shutdown.

Just months after finally launching in October 2023, Apple Pay Later is shutting down. The service, which allows Apple users in the US to split the cost of purchases into four payments spread over six weeks, was first launched more than a year ago in March 2023. It was only available to a limited number of users, however. The service finally reached general availability for US users in October and lasted just eight months before being canned.

How to set up and use Apple Pay across your devices

Apple Pay makes purchases more convenient with just a tap of your iPhone or Apple Watch. You can also checkout online without digging out your wallet.

What was Apple Pay Later?

Interest-free loans to spread the cost of purchases

Apple

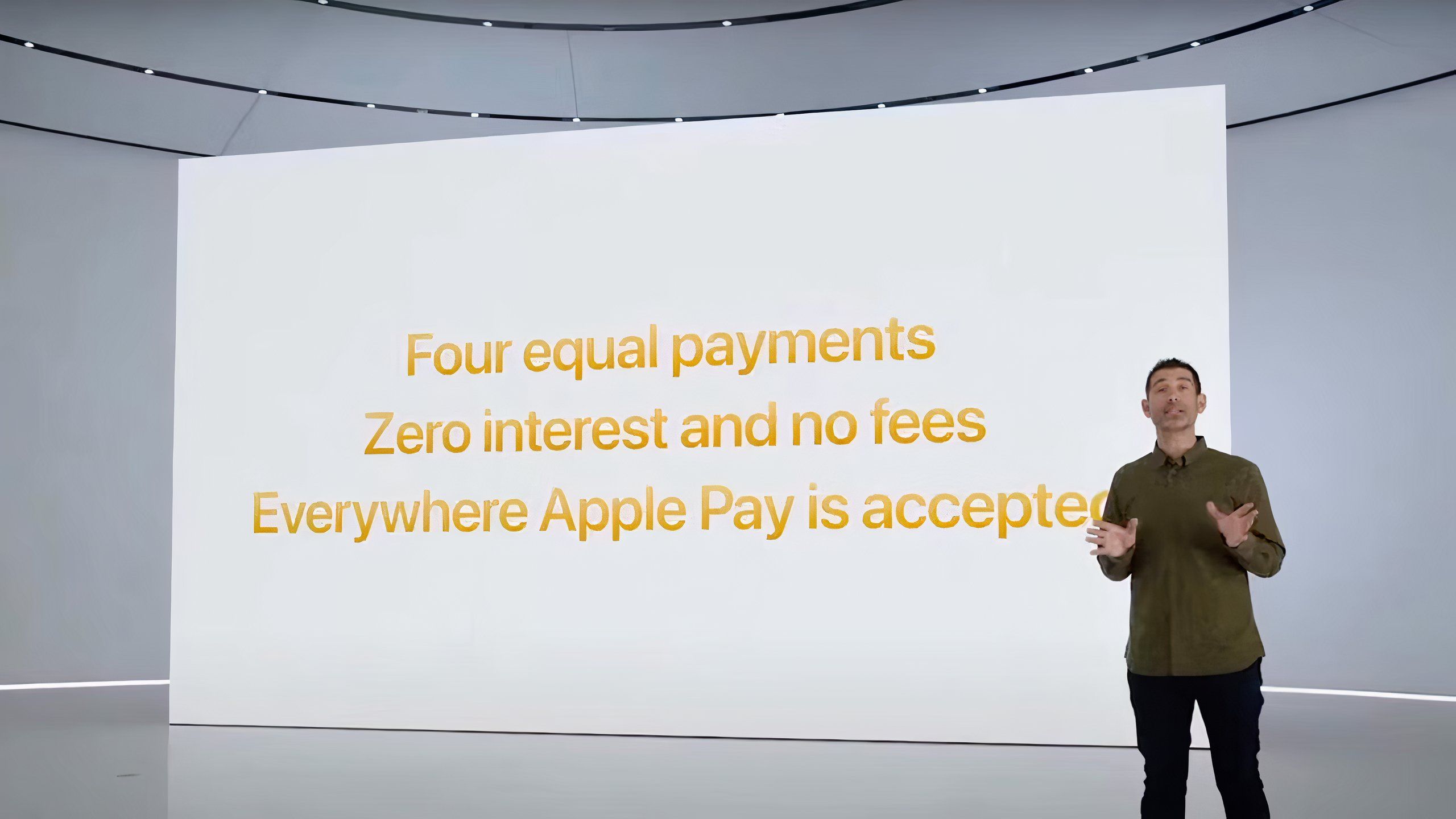

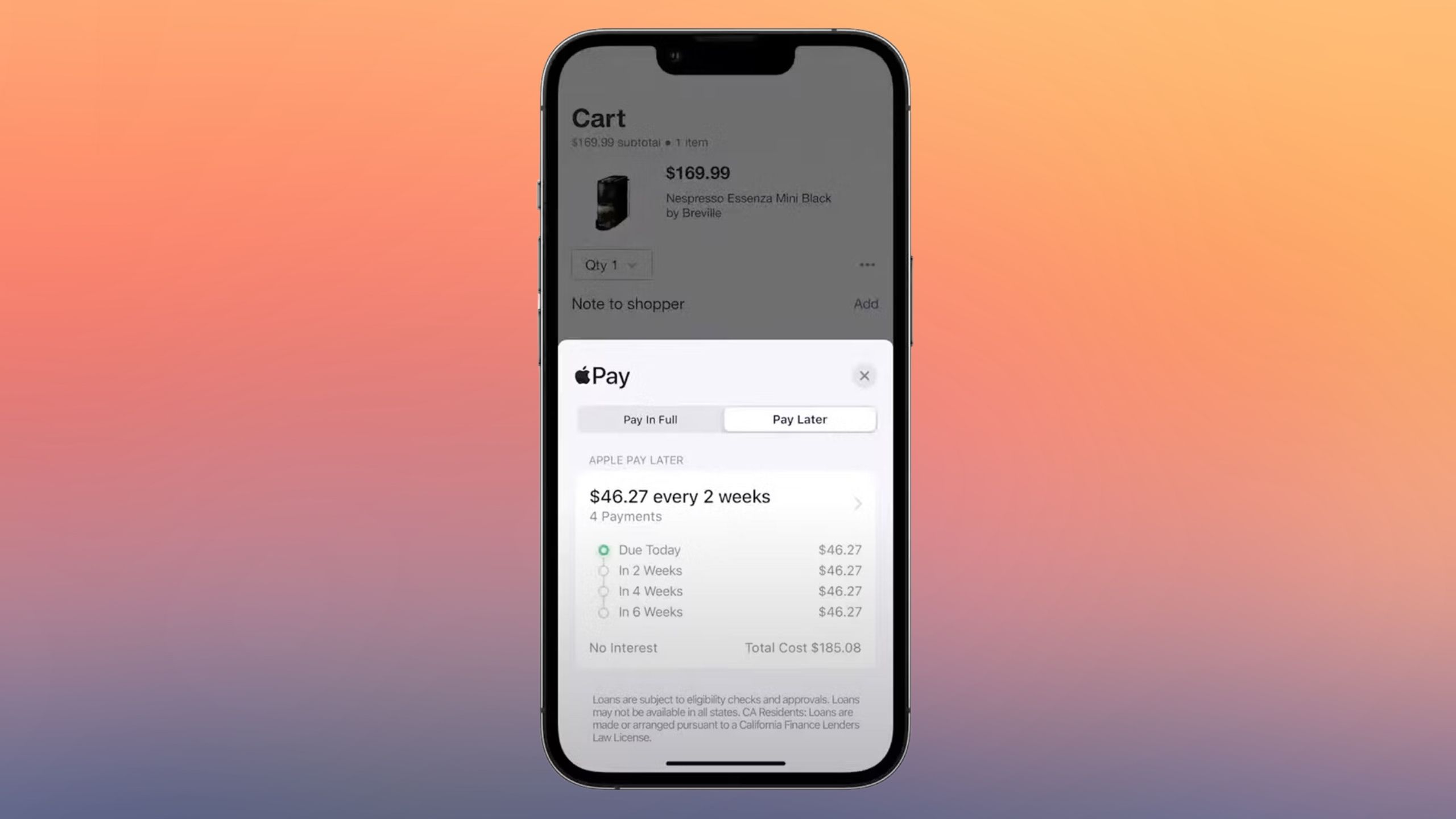

Apple Pay Later was a buy now, pay later scheme run by Apple. It could be used for purchases between $50 and $1,000 and took the form of an interest-free, zero-fee loan. The cost of the payment was split into four equal parts, with the first quarter being paid at the time of purchase, the second installment after two weeks, the third after four weeks, and the final payment after six weeks.

The service was only available to users in the US and involved applying for a loan through the Wallet app. A soft credit check would then be run to check eligibility. Once approved, it was possible to select the Apple Pay Later option when making a payment through Apple Pay. The loan was financed by Apple Financing LLC, a subsidiary of Apple Inc.

Why is Apple Pay Later being shut down?

Loans will be available through other providers

Apple/Pocket-lint

Apple announced the decision to close the Apple Pay Later service in a statement to 9to5Mac. It explains that the Apple Pay Later service is being withdrawn but doesn’t give a clear reason why. However, it makes clear that a similar service is on the way that will offer installment loans through credit and debit cards as well as other lenders when using Apple Pay. These loans will be available worldwide, unlike Apple Pay Later which was exclusive to the US.

The full statement released to 9to5Mac is as follows:

“Starting later this year, users across the globe will be able to access installment loans offered through credit and debit cards, as well as lenders, when checking out with Apple Pay. With the introduction of this new global installment loan offering, we will no longer offer Apple Pay Later in the U.S. Our focus continues to be on providing our users with access to easy, secure and private payment options with Apple Pay, and this solution will enable us to bring flexible payments to more users, in more places across the globe, in collaboration with Apple Pay enabled banks and lenders.”

What will happen to existing Apple Pay Later account holders?

Current loans and purchases need not worry

Apple/Pocket-lint

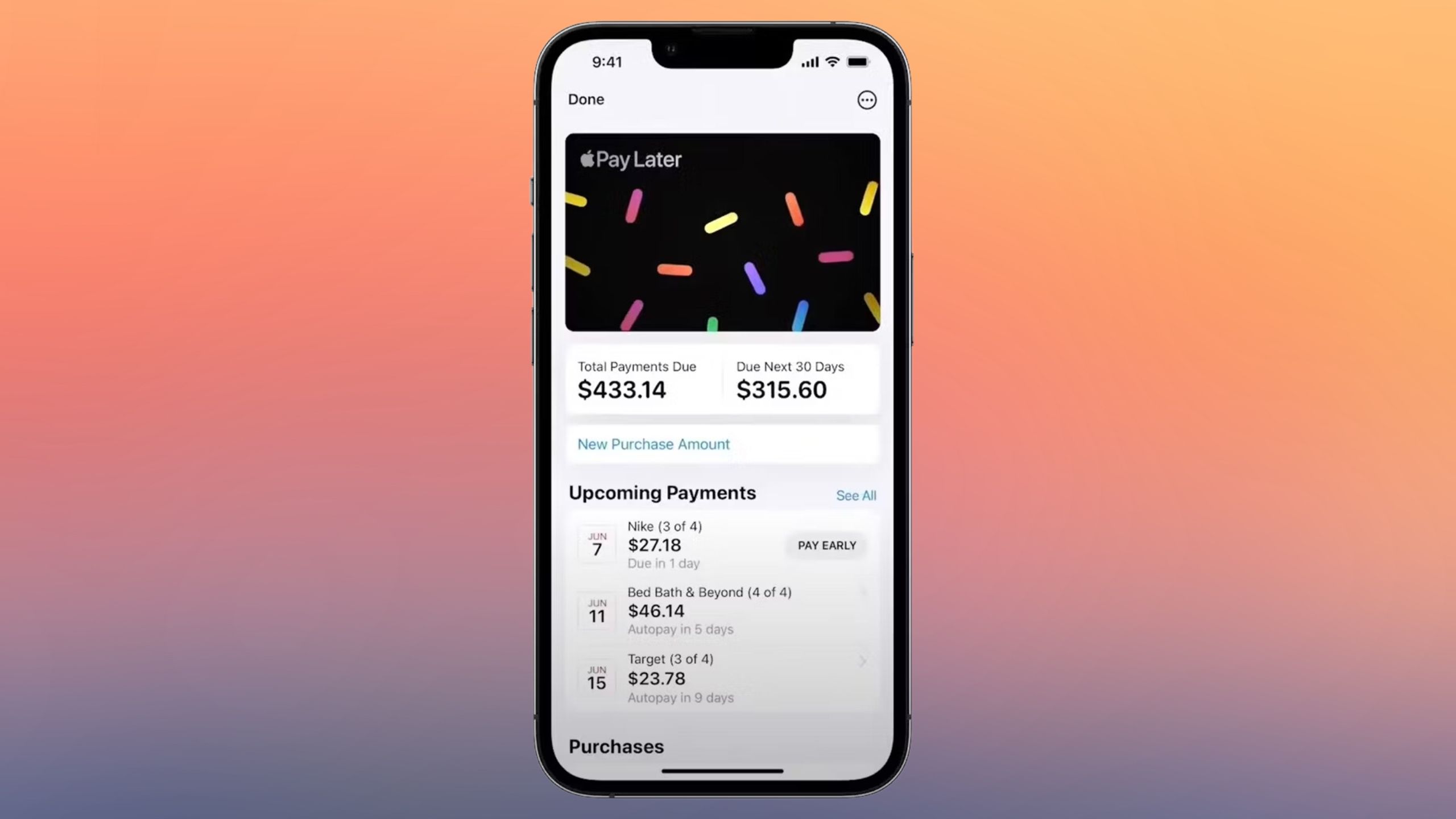

The official support page for Apple Pay Later now contains a message that reads: Apple Pay Later is no longer offering new loans. Existing Apple Pay Later loans and purchases are not affected.

Apple Pay Later is no longer offering new loans. Existing Apple Pay Later loans and purchases are not affected.

Apple’s support page goes on to indicate that users with active loans should continue to make their loan payments by their due date. Any purchases made with Apple Pay Later that have not yet shipped will also continue with the scheduled payments. However, no new loans will be offered.

All the best emulators available to download from Apple’s App Store

Now that emulators are allowed in the Apple App Store, a variety of impressive choices have popped up for iPhone and iPad users.

Trending Products

Cooler Master MasterBox Q300L Micro-ATX Tower with Magnetic Design Dust Filter, Transparent Acrylic Side Panel…

ASUS TUF Gaming GT301 ZAKU II Edition ATX mid-Tower Compact case with Tempered Glass Side Panel, Honeycomb Front Panel…

ASUS TUF Gaming GT501 Mid-Tower Computer Case for up to EATX Motherboards with USB 3.0 Front Panel Cases GT501/GRY/WITH…

be quiet! Pure Base 500DX Black, Mid Tower ATX case, ARGB, 3 pre-installed Pure Wings 2, BGW37, tempered glass window

ASUS ROG Strix Helios GX601 White Edition RGB Mid-Tower Computer Case for ATX/EATX Motherboards with tempered glass…